Test and Deploy: A New Era for CBDCs

John Kiff and Chris Ostrowski are inviting all central banks to comment and give feedback on this article. Is the Test and Deploy approach to CBDCs something that your central bank will consider in 2024?

Test and Deploy: A New Era for CBDCs

pdf

“Death Star” central bank digital currency (CBDC) has been met with underwhelming demand. However, some central banks are pushing ahead with more modestly-scaled efforts that are laser focused on specific use cases using the “test and deploy” approach.

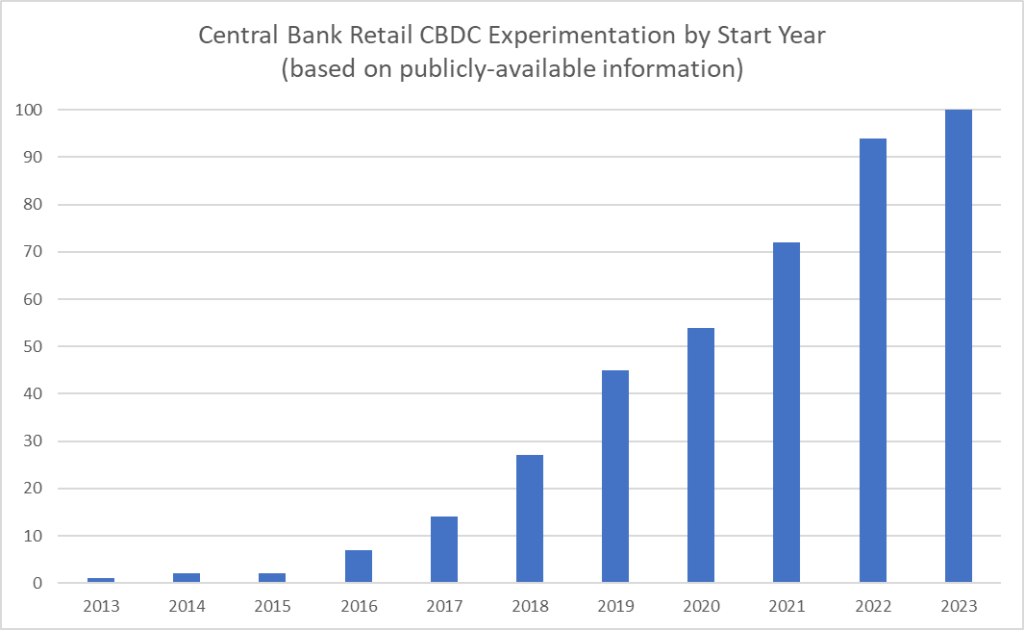

According to CBDCTracker.org at least 100 central banks have launched, piloted or exploring (or have recently explored) retail central bank digital currency (CBDC), of which 16 have either launched or piloted them, and 17 conducted proof-of-concept experiments.[1] We say “at least” because the count is based on reliable public sources (e.g., central banks themselves) and many other central banks choose to keep their CBDC thoughts to themselves. In any case, the growth in the number of retail CBDC explorers until recently has been remarkable.

No central bank has launched a retail CBDC since early 2022 (Jamaica’s JAM-DEX) and there is no sign of an imminent launch in early 2024, except the Eastern Caribbean Central Bank’s DCash which has been in its pilot phase since 2021). Nevertheless, the levels of interest and the rigor of analysis undertaken by central banks continues to increase, and almost every G20 central bank is in advanced stages of retail CBDC research.

Why a go-slow approach may be appropriate for “death star” CBDC

One of the reasons for the seemingly plodding pace of retail CBDC progress is that most central banks, and particularly the G20 and advanced economy central banks, follow some variation of the “staged approach”. For example, the IMF advocates a “5P” decision-making framework (preparation, proof of concept, prototype, pilot, and production) in which users are not involved until the 4th phase.

Such an approach is appropriate for “death star” retail CBDCs aimed to be general-purpose payment instruments for all residents since the stakes and risks are so high. If it’s a flub, there could be reputational damage to the central bank and government. If it’s too “successful” it would threaten existing payment service providers and deposit-taking banks.

However, as central banks navigate this knife edge, they end up creating retail CBDCs that offer nothing new and compelling to end users. (By itself, the safety offered by being issued and backed by a central bank isn’t very compelling where commercial bank money is covered by deposit insurance.)

And central banks are hand-tied when it comes to offering potentially attractive features, such as cash-like privacy or remuneration. Cash-like privacy is shunned because it might violate the anti-money laundering and countering the financing of terrorism (AML/CFT) requirements set by the Financial Action Task Force (FATF). And a remunerated retail CBDC may be too attractive as a store of value and threaten deposit-taking banks.

Hence, it is no surprise that to date all death star retail CBDCs that have launched have been met with underwhelming demand (e.g., Bahamas, China, Jamaica, and Nigeria). And a side effect of all of this is that it becomes easy for critics to say things like “CBDCs are solutions looking for a problem” or “they don’t do anything new”, which in turn leads to policy battles – often fought on ideological terms – about the role of CBDC in society.

A “test and deploy” approach may be more appropriate for smaller-scale RCBDC

There is another path forward, which more and more central banks are eager to pursue. A “test and deploy” approach aimed at narrow use cases with an abbreviated preparation phase and rapid iterations through the next three phases (proof-of-concept, prototype, and pilot) whereby retail CBDC is issued to real end users in a safe and controlled manner to offer insight into user demand and experience. By focusing on narrow use cases, the risks associated with a death star retail CBDC are absent, which allows for the more agile approach.

The test and deploy approach accelerates the process of actually issuing retail CBDC to end users who can utilize a new form of money in a way which improves their lives, their experiences of using money, and offers new benefits to the central bank. A simple use case such as migrant worker remittances, government-to-person benefits payments, or a smart contract-based car-loan can create retail CBDC for a limited number of people, for a limited time, which can be rolled out completely safely. In all these cases the user and the central bank see the tangible benefits much faster than they would with the staged approach.

As an example, the central bank of Hungary, Magyar Nemzeti Bank (MNB), has taken the test and deploy approach by issuing CBDC to unbanked young people. In doing so they now have a retail CBDC in a way which offers real insight into how members of the public interact with this new form of money. The central banks of Australia, Kazakhstan, and Hong Kong are also piloting CBDC in test and deploy style:

- The Reserve Bank of Australia collaborated with the Digital Finance Cooperative Research Centre on 16 eAUD use cases, many of which leveraged the ability to make programmable payments to facilitate multi-party, conditional or escrowed payments, or to enable atomic settlement of transactions in tokenized assets.

- The National Bank of Kazakhstan is launching digital tenge pilots to test various use cases, including the automated distribution of social support payments using smart contracts, and automating the distribution and payments processing of student canteen subsidies.

- The Hong Kong Monetary Authority conducted 14 e-HKD pilots that tested programmability, tokenization, and atomic settlement associated, and a second phase will explore new cases and delve deeper into select pilots from the first phase.

The way forward with test and deploy

Central banks often don’t know how to test a use case when piloting a retail CBDC without being seen to be choosing a technology… but while the CBDC doesn’t exist, it’s impossible to tell what type of impact these innovations will have. Inevitably, technology and design choices become more important as practitioners move away from pure policy and seek to test how public money might operate in a live field environment, and central banks are right to be wary of locking themselves into a technology even at the test and deploy stage. However, test and deploy offers a neutral route for central banks to live test a CBDC without being forced into technology choices at an early stage.

The most appropriate test and deploy use cases will vary from country-to-country, but looking to the MNB offers a workable path forward. As the MNB’s Aniko Szombati has said, “the test and deploy approach has served the MNB well, as we can innovate safely in a live environment”. The test and deploy framework offers central banks a way to quickly and safely deploy an actual CBDC, which is essential to move retail CBDCs from theory to reality.

However, starting with the user experience is well outside the comfort zone of many central banks, but SODA can offer Club SODA members the tools to test and deploy CBDCs in a neutral and safe manner. This will not be a splashy central bank death star triumph on day one, but it will speed CBDC progress while avoiding a dud star.

[1] RCBDC is a broadly available general purpose digital payment instrument, denominated in the jurisdiction’s unit of account, that is a direct liability of the jurisdiction’s monetary authority.

Test and Deploy: A New Era for CBDCs

pdf

The Sovereign Official Digital Association (SODA) is a technology-agnostic firm offering advisory services at the intersection of central banking, digital finance and the web3 industry, aiming to make public digital money a reality. SODA believes institutions in the existing financial ecosystem should have access to the tools and resources they need to move from discussion to action. SODA offers ‘real life’ use cases to help test digital money and drive adoption as central banks and other public institutions explore the future of a more financially inclusive world powered by interoperable networks. SODA would love you to join us on this journey – please get in touch (chris@sodapublicmoney.org).